Get Your Crypto Taxes Right and Avoid That April Anxiety

Time is money. Take both back with our easy-to-use service and make taxes a breeze.

Fast

Reliable

Private

Secure

Honest

No more guessing!

Calculate your crypto taxes quickly and correctly with just a few clicks.

Don’t Let Crypto Taxes Bog You Down

Keep Your Data Private and Secure

Stay Confident, Be Honest, Pay Less

I approached ProfitStance skeptically as I do with all new crypto tax products, but in this case I was pleasantly surprised because not only was the tool easy to use, but the numbers matched what my accountant produced in 2017. It was incredible! These guys have their ducks in a row!

JOHN C.

High Growth Enabler & Part Time Crypto Investor

Stop Worrying About What Forms You Need

ProfitStance gets you the correct documents in minutes.

Form 8949

Schedule D

The Peace of Mind you Need

Benefits Once you Sign Up

ProfitStance’s standard package will get you immediate access to the Form 8949 and Schedule D tax forms. Everything you need to start reporting your crypto income!

Our $1,000,000 Guarantee

We are constantly testing and re-testing our calculations. We guarantee 100% accuracy or we’ll cover your IRS interest and fines up to $1,000,000.

Your Cryptocurrency Kept in Your Hands

Analytics to Guide you to the future

Start Now In Just 3 Easy Steps

1.

Create an account.

It’s pain-free and quick! We are available to walk you through the process and you’ll be up and running in just minutes.

2.

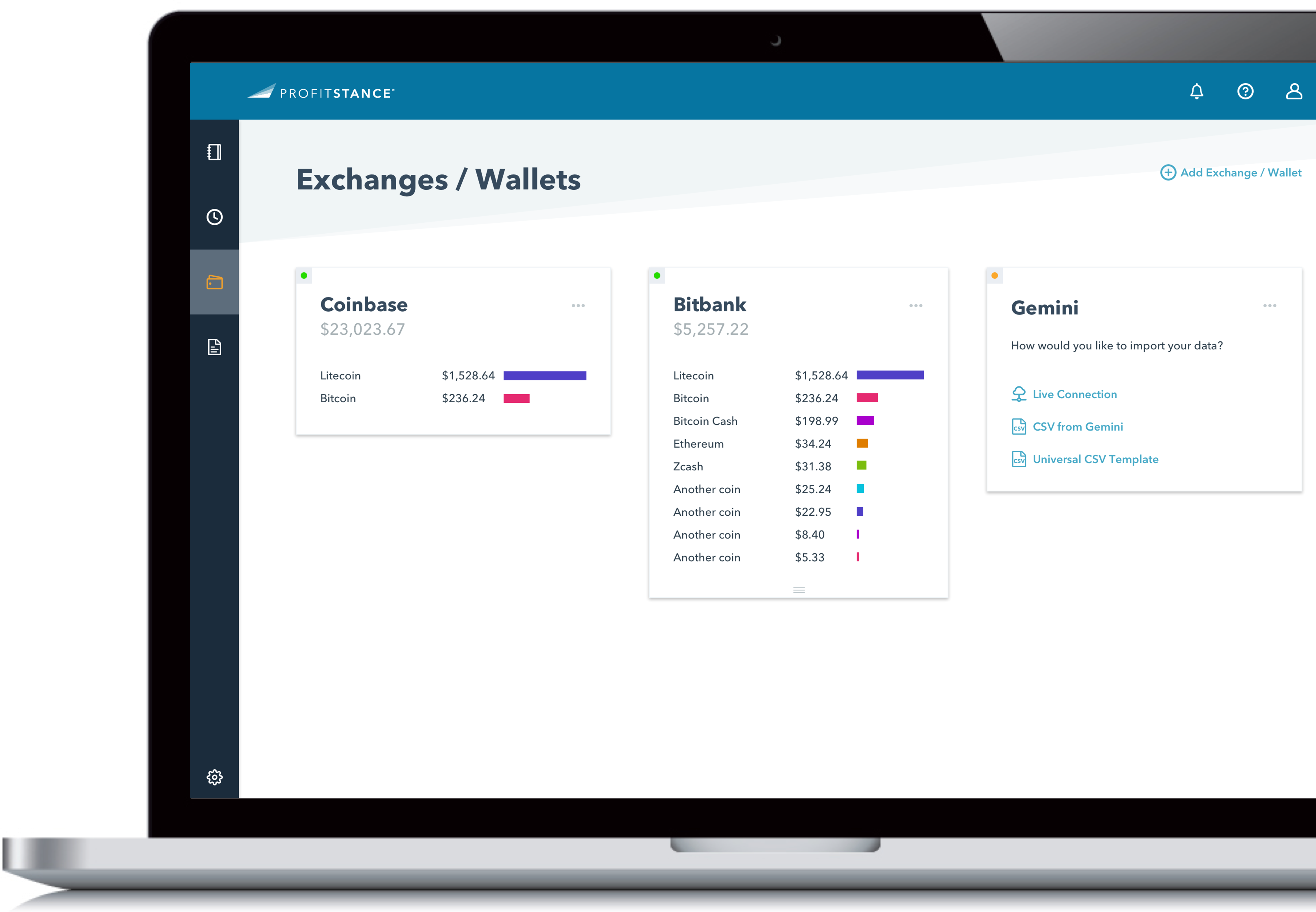

Connect your exchanges and wallets.

With just a few clicks you’ll connect to your exchanges and wallets. And don’t worry, we keep your data completely anonymous within our system.

3.

Print your tax documents.

In just minutes you’ll have all your calculations done and your forms ready to download and print. Sit back, relax, and know your crypto taxes are done, done immediately, and done right.

Software Created by Crypto Owners for Crypto Owners

Don't Get Lost in the Math!

“Winging it” with crypto taxes risks audits, fines, and fees. Don’t put yourself at risk.

© Copyright ProfitStance, Inc. All Rights Reserved.

Services are provided by ProfitStance, Inc. This is not an offer or solicitation for brokerage services or other products or services in any jurisdiction where ProfitStance is not authorized to do business or where such offer or solicitation would be contrary to local laws and regulations of that jurisdiction. Cryptocurrency trading involves substantial risk of los and is not suitable for all investors. Investors should understand the risks involved in trading and carefully consider whether suce trading is suitable in light of their financial circumstances and resources. Past performance is not necessarily indicative of future results.