Calculate Your Clients’ Crypto Tax Liability

Spend minutes instead of hours, and become a trusted voice in cryptocurrency tax.ProfitStance CPA Portal

Don’t blow your budget! With ProfitStance, your client’s crypto taxes will be calculated in minutes instead of hours.

Provide better service to your clients with accurate, streamlined calculations.

Top Crypto Tax Platform

Automatic Crypto Tax Calculations

100% Accuracy Guaranteed

Simplify Your Process in 3 Simple Steps

1.

Request a Demo

Learn what our ProfitStance CPA Portal can do for your clients.

2.

Set Up Your Account

Our ProfitStance team will help you set up your white-labeled account.

3.

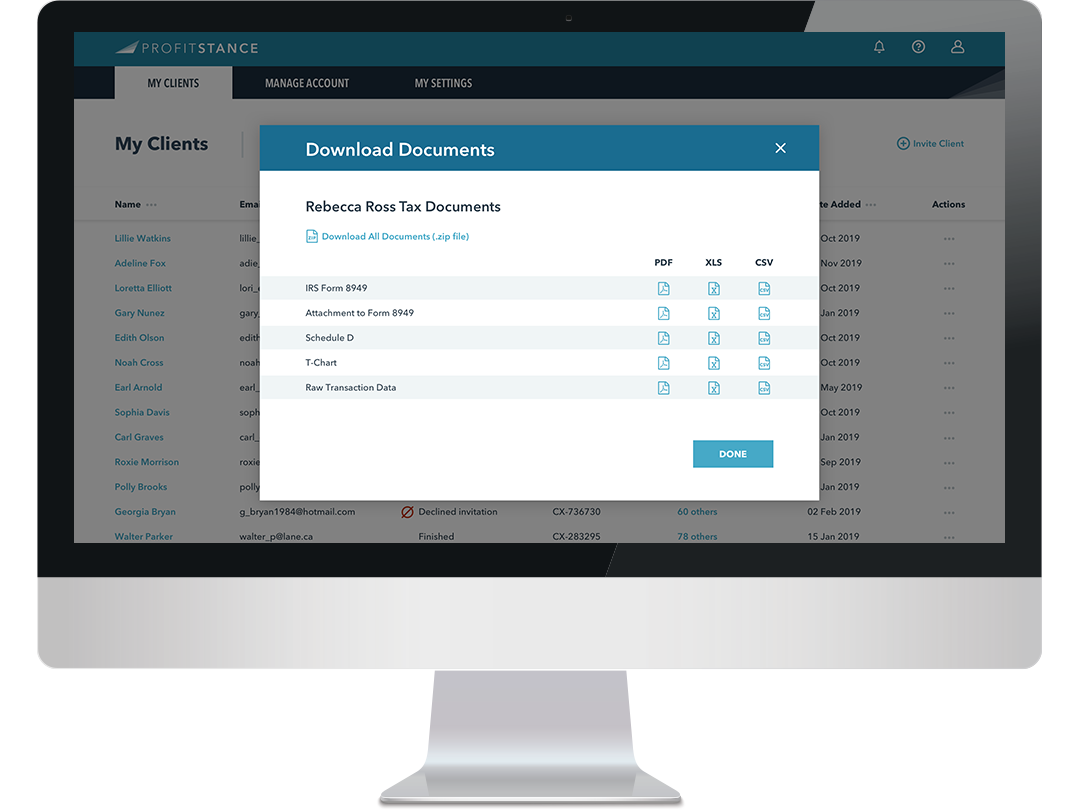

Export Required Docs

Receive a completed Form 8949 and Schedule D for each of your clients.

I approached ProfitStance skeptically as I do with all new crypto tax products, but in this case I was pleasantly surprised because not only was the tool easy to use, but the numbers matched what my accountant produced in 2017. It was incredible! These guys have their ducks in a row!

JOHN C.

High Growth Enabler & Part Time Crypto Investor

Software Tailored to Your Firm’s Needs

Don’t make your clients pay more tax

because you missed deductions they should have had

Train Your CPAs to Become Experts in Crypto Tax

Give your staff the knowledge they need to handle business income and capital gains taxes from crypto investments with our crypto tax CPE course.

Course is approved by NASBA, the IRS, and qualified by AICPA.

© Copyright ProfitStance, Inc. All Rights Reserved.

Services are provided by ProfitStance, Inc. This is not an offer or solicitation for brokerage services or other products or services in any jurisdiction where ProfitStance is not authorized to do business or where such offer or solicitation would be contrary to local laws and regulations of that jurisdiction. Cryptocurrency trading involves substantial risk of los and is not suitable for all investors. Investors should understand the risks involved in trading and carefully consider whether suce trading is suitable in light of their financial circumstances and resources. Past performance is not necessarily indicative of future results.